One Easy Way To Save Yourself And Your Clients From A Headache This Tax Season

While most clients have their accounting act together, some don’t—and that can create problems for you as an independent contractor when it’s time to prepare and file your tax returns.

I’ve gotten 1099 forms at the end of the tax year that either under- or over-reported the “nonemployee compensation” clients paid me throughout the year.

If the income records you report and those of your clients don’t match up, it’s a big deal. If they under-report, they’ll be paying more tax than they should be. If they over-report, it will bring you a boatload of aggravation. You’ll be stuck backtracking through records to show them where they made their error(s), and then you’ll need to wait until you get a revised 1099 before you can file your taxes. The income in your accounting data (whether in a system like Quickbooks, in Excel worksheets, or logged manually in a notebook) needs to match what your clients are saying they paid you.

After getting several inaccurate 1099s last year and dealing with the headache (and putting my clients through the hassle) of requesting that they be reissued with the correct information, I decided to get proactive in confirming our information is in agreement this year.

Here’s how…

One Easy Way Solopreneurs Can Make Tax Season Less Painful

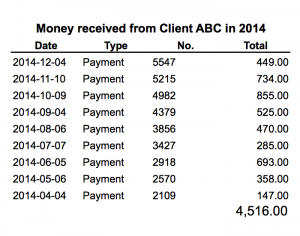

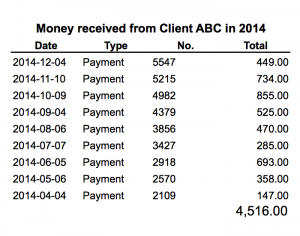

Whether you use Quickbooks, Excel, or some other method of tracking your income by customer, export or create a file that shows (at the very least):

- Dates payments were received

- Check numbers (or other reference numbers if paid in a different way) associated with each payment

- Amounts of payments

- Sum of all payments for that tax year

Here’s a sample of what that might look like.

I’ve sent one of these to every client who did at least $600 worth (the magic number for when that income needs to be reported on a 1099) of business with me in 2014.

By doing the same, you can show your clients what your records say so they can check to make sure theirs are in sync. That way, if you’re not in alignment, you can investigate and resolve the discrepancy BEFORE they issue their 1099s to you.

Keep in mind, whether your clients are doing their own bookkeeping or if they outsource it to someone else, mistakes can—and do—happen. By proactively exchanging information as tax season approaches, you might spare yourself and them from major headaches.

By Dawn Mentzer

Speaking of sparing yourself headaches, if you’re struggling to keep up with writing blog content that grabs attention and gives your readers value, let’s talk!

Please note that this post is not meant to serve as professional accounting advice. It’s for information purposes only.

Leave a Reply